It is important to note that the loan term or tenure also affects the EMI calculation. While the loan amount and interest rate primarily determine the EMI amount, the tenure determines the number of monthly installments. When you make your monthly EMI payment, a portion of that payment is designated for covering the interest charges. The interest is calculated based on the loan’s outstanding balance, which is the remaining amount you owe.

Personal Loan EMI Calculator

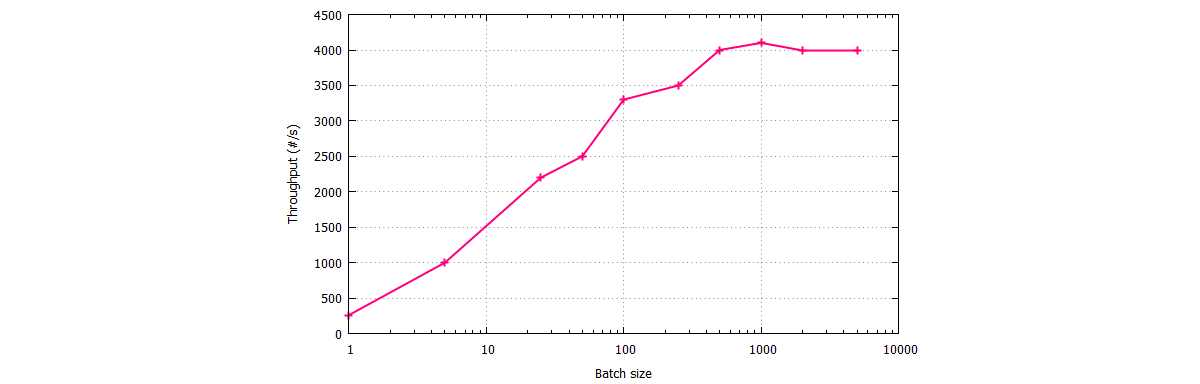

An EMI (Equated Monthly Installment) calculator is a valuable tool that helps individuals understand the financial implications of their loans. EMI calculator is designed to give users a precise estimation of the monthly repayment amount they will need to make towards their loans. By inputting the loan amount, interest rate, and tenure into the loan calculator, users can instantly obtain the EMI amount they will be responsible for. This information is valuable regarding financial planning, budgeting, and making informed decisions about borrowing. This online tool can be used as home loan, car loan or personal loan EMI calculator. Another significant benefit of online EMI calculator is the ability to compare different loan options.

Some tips on getting your first loan

The E/M code calculator is a great training tool for students, coders, auditors, and especially providers. Once completed, all entered data will automatically be deleted from the tool and our system permanently. That also means if you forget to https://www.business-accounting.net/what-is-an-income-statement-financial-reports-for/ print or save, the information will be gone upon leaving the page or exiting the tool. You can use ET Money’s EMI calculator to calculate your monthly EMI. You can do this by simply entering the variables such as loan amount, rate and tenure.

EM vs. REM: The differences

- With richer language understanding and awareness of your personal context, Siri is more capable and helpful than ever.

- By entering your loan amount, rate of interest, and loan tenure, you can calculate your EMI.

- This enables borrowers to make well-informed decisions and select loans with the most favorable terms and repayment schedules.

- If you’re working with a budget, you know it’s always good to have backup funds if things don’t go as planned.

- The loan’s EMI is required to be repaid with interest after a moratorium period.

Consider the total interest amount to assess the overall cost of borrowing and determine which option is more financially favorable. Loan Option 2 has a shorter tenure of 4 years, which means you’ll pay interest for a shorter duration, resulting in a lower total interest payable ($12,230.84). Consider a practical example to compare two loan options using an EMI calculator. In the context of monthly EMI payments, interest refers to the cost the lender charges for borrowing the funds. It represents the additional amount you pay on top of the principal amount. When you make your monthly EMI payment, a certain percentage of that payment is allocated towards reducing the principal amount owed.

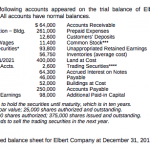

Trial Balance

You just have to enter the loan information and it will calculate your EMI. Longer tenures with lower EMIs may seem more attractive initially, as they offer greater affordability. However, with each subsequent payment, a more significant percentage of the EMI is directed towards reducing the principal balance, decreasing the interest component. Evaluation and Management (E/M) codes are a subset of the Current Procedural Terminology (CPT) code set, established and copyrighted by the American Medical Association (AMA).

CPT Changes

Affording good education in recent times has been quite a task for parents as its cost has risen at a rapid pace. To finance this cost, an education loan is one of the best options a parent can opt for. Such loans can be taken for a student’s education within the country https://www.adprun.net/ or even overseas. The loan’s EMI is required to be repaid with interest after a moratorium period. By entering the loan amount, rate of interest, and loan tenure in the Education Loan EMI Calculator, you can calculate the sum of the EMI amount which you need to repay.

From passwords to verifications and security alerts, find them all securely stored in the Passwords app. Game Mode minimizes background activity to sustain consistently high frame rates how to read financial reports for expenses for hours of continuous gameplay. Now you can send a Tapback with any emoji or sticker, including Live Stickers made from your own photos and stickers from your favorite sticker packs.

On the contrary, shorter tenures offer the advantage of faster debt repayment, reducing the overall interest burden. However, they may also lead to higher EMIs, which can strain your monthly budget. When selecting a loan tenure, it is crucial to evaluate your financial goals, income stability, and repayment capacity. Analyze these results carefully to understand the financial implications of your loan. Computing EMI for different combinations of principal loan amount, interest rates and loan term using the above EMI formula by hand or MS Excel is time consuming, complex and error prone.

The loan amount refers to the principal sum you borrow from a lender. It represents the total value of the loan before interest and fees are added. In EMI calculations, the loan amount directly impacts the EMI amount. A larger loan requires a higher monthly repayment to cover the principal and interest. Over time, the principal component of your monthly EMI payments grows while the interest component gradually decreases.

The exact percentage allocated towards payment of the principal depends on the interest rate. Even though your monthly EMI payment won’t change, the proportion of principal and interest components will change with time. With each successive payment, you’ll pay more towards the principal and less in interest. EMI calculators offer significant benefits and are indispensable tools for effective loan management. They provide knowledge, support optimal decision-making, aid in budgeting and financial planning, and contribute to long-term financial stability. Although Loan Option 1 has a lower monthly EMI, it has a longer tenure of 5 years, resulting in a higher total interest payable over the loan period ($17,985.20).

A loan EMI calculator allows borrowers to experiment with different loan amounts, interest rates, and tenures, helping them understand how these variables impact their monthly repayments. It empowers borrowers to make informed decisions about loan affordability and choose loan options that align with their financial capabilities. It helps borrowers avoid excessive debt or entering into loans that may strain their finances. The more areas that a physician touches/documents and examines, the more thorough and detailed the examination.