Long and short positions are taken depending on which way a trader expects an asset’s price to move. A short position is established by borrowing and selling an asset, then buying it back after a price drop to keep the difference. Long positions simply mean buying in with the expectation of the price increasing, and selling when it does. Margin trading is using money borrowed from your broker to open positions larger than you would normally have been able to.

Long Position:

Being regulated and registered with a law-abiding authority means that the broker will most definitely strictly adhere to the laws and regulations put forth by the concerned body. Again, just like Reddit users, Quora users too did not hold many discussions about the broker. With that being said, one Quora user, who also claims to be an experienced trader, did find the brokerage firm to have a lot of good things about it.

TRUSTED PAYMENT PROVIDERS

You can utilise a comprehensive selection of daily signals, market analysis, economic news, trading academy, webinars and seminars. This is a really generous selection and puts them amongst the best brokers when it comes to education. BlackBull Markets is an online trading brokerage firm that has its headquarters in Auckland, New Zealand.

Realized Gains & Losses:

- Swap fees vary on every financial instrument provided by the broker.

- Between 74-89% of retail investor accounts lose money when trading CFDs.

- The website has an economic calendar that displays up to date listings of economic events, including the country impacted and level of impact.

- Institutions most often include insurance companies, pension funds and other entities that govern major savings or demonstrate large cash flows.

- The aggregate value of a group of selected stocks, the index is used to describe its market and compare returns on investment.

Used for informative purposes, a quote is an indication of what real market value equals. In Forex, ‘quote’ can also refer to bid and ask prices as they appear in a currency https://forexbroker-listing.com/ pair. An order that opens only if the asset achieves a predetermined price value. The four types of pending available are buy limit, sell limit, buy stop and sell stop.

New EU Emissions Rules Place Auto Giants at Risk of Massive Fines

It may be expressed either in quantitative (currency) terms or as a percentage of the investment. Securities traded not through a centralized exchange but through a dealer or dealer network. Stocks traded over-the-counter are referred to as unlisted and are usually offered by smaller companies. The control of interest rates, bank reserve ratio requirements, and in some cases money printing, used to influence the supply of money.

Before its establishment, traders operated in coffee houses, since they were not allowed to enter the Royal Exchange (est. 16th century), and established the first trading room in 1773. The United Kingdom’s regional exchanges merged with the LSE in 1973, which was then privatized alvexo forex broker in 1986 (the Big Bang), and today, the exchange lists 2500 companies from 68 countries. A transaction that is immediately executed based on the asset value currently quoted in the platform. An analysis form based on identifying the intrinsic value of an asset.

Alvexo Research and Analysis Tools

Alvexo chose to make their trading platform a web-based one to eradicate the unnecessary extra step of having to download the platform onto your personal computer. This platform is available across multiple devices as all you need is the URL and a supported web browser. Its built-in tools make for a faster and clearer trading experience. As mentioned earlier in the previous section of this review, the type of account you hold is the main factor that determines how high your spread rates will be. It has been observed that Prime and Elite account holders incur the lowest spread charges, whereas the spreads for a Classic account holder are the greatest. If we take a look at the AUD/NZD currency pair, the spread is from 14.9 pips on a Classic account, but that figure is slashed to 6.4 pips on an Elite account.

Either the commodity or its cash value is then transferred between trading parties. Usually, the futures contract is a means of hedging the asset’s value and the asset itself is not actually delivered. In Forex trading, an amount is withdrawn from one’s general account balance and multiplied by the broker’s leverage to provide the investment amount. A market in which assets are difficult to buy and sell because of a small number of buyers and sellers. This may be a result of an asset that is highly valued but hard to sell in a swift manner due to the price (requiring a significant discount), a lack of potential buyers, or any other reason. Illiquid assets are those that are difficult to sell (sometimes at any price).

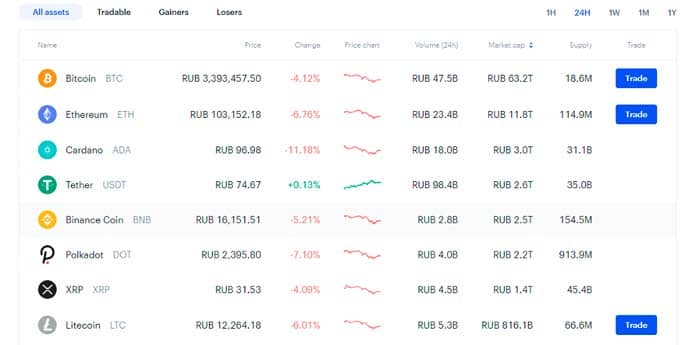

When clicking on any asset you’ll land on the asset view where traders can easily view several key data points about every asset by switching tabs and also explore their default trading charts. The stop loss level specified within your trade ensures that the asset in question is sold when it reaches a certain level. This can prevent significant losses in the case of a long downward trend and an otherwise occupied trader, as the position is automatically closed when it arrives at the level specified. Technical analysis is a technique that uses past values and volume of an asset to determine patterns for price activity in the future.

They provide a variety of account types along with a range of trading tools and trading academy. Additionally, to bestow upon its clients the ability to diversify their portfolios as much as possible, it has made available 450+ financial instruments on its platforms. These include currency pairs, shares, cryptocurrencies, commodities, indices, and last but not least, bonds. Alvexo allows clients to trade CFDs in these assets, allowing them to place orders for trades they may not have sufficient capital for. Most users would agree that their high maximum leverage gives them the freedom to trade larger quantities of goods for a fraction of the price. Overall, I like that Alvexo is a regulated broker with a range of flexible platforms and account types to suit different trading strategies.

In law, contracts, wills and deeds are also considered instruments. Derivatives may be traded through an exchange or over-the-counter. Alvexo is an established and regulated online broker offering 450+ assets to trade on flexible trading platforms with competitive fees.

As a regulated broker, Alvexo must abide by strict financial requirements that include regular internal auditing and external monthly monitoring by a certified public accountant. The company is a member of the Investor Compensation Fund (ICF) and is subject to maintaining minimum capital requirements. To invest in stocks on Alvexo, create an account with the broker, get verified, and deposit sufficient funds into your account. Once done, you are ready to choose any real stock on their platform and invest in it. Alvexo’s mobile app and web-based trading platform were designed keeping in mind the users’ needs and are incredibly easy to navigate and use. Moreover, their customer service team can be contacted via email, phone, and even their live chat function.

A forex transaction must usually be settled within two business days (the value date). Rolling over a transaction is chargeable, based on the interest rate differential between the currency pair constituents. If you purchased a pair with a higher rate of interest, you will earn interest. If you sold the pair with a higher rate of interest, you will pay interest. Executing a series of investment strategies aimed at locking in a profit and reducing risk. In financial futures, rolling back involves closing a position and entering a new one for the same underlying asset but with a closer expiration date.