It is important to note that funds spent on repair or in conducting normal maintenance on assets are not considered capital expenditures and should be expensed on the income statement. The key difference between capital expenditures and operating expenses is that operating expenses recur on a regular and predictable basis such as rent, wages, and utility costs. Operating expenses are shown on the income statement and are fully tax-deductible. If you have access to a company’s cash flow statement, then no calculation is necessary and you can simply see the capital expenditures that were made in the investing cash flow section.

Step 1 of 3

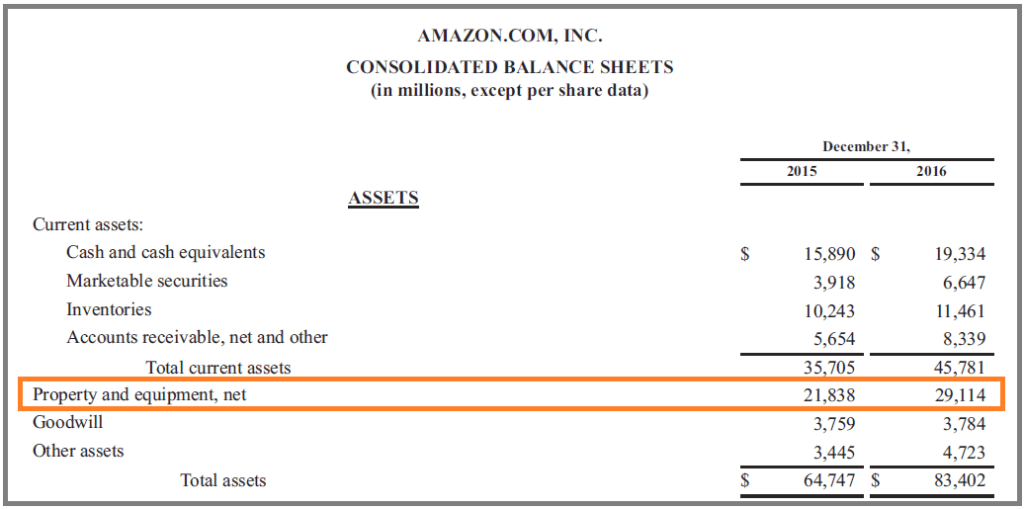

By contrast, both the purchase of inventory for resale and expenditure on repairs and maintenance of capital equipment go through the company’s Profit & Loss, thus reducing earnings for the period. Maintenance CapEx is found on the cash flow statement under the investingactivities section. In 2021, this company reported the value of all fixed, long-term assets as $3 million. Due to the sale of some office space and changes to software licensing, this company reported the value of these assets in 2022 to equal $2.5 million. The company reported total depreciation and amortization for 2022 as $1 million. As explained by Investopedia, the amount of capital expenditures incurred by a company depends upon the industry occupied by it.

What Is the Difference Between CapEx and OpEx?

- Operating expenses can be fully deducted from the company’s taxes in the same year in which the expenses occur, unlike capital expenditures.

- A company may acquire another business to expand its operations or gain access to new markets, customers, or products.

- The company reported total depreciation and amortization for 2022 as $1 million.

- For example, after a company acquires a piece of equipment, it may be difficult to resell it at its original price.

- The assets in discussion here could be machinery, facilities, technology, or infrastructure such as buildings, offices, or plants.

Other common capital expenditures for real estate include replacing an old roof, adding or replacing the HVAC system, and adding other improvements to the property such as a deck or pool. For its 2022 fiscal year, ending January 28, 2023, Target Corporation reported approximately $5.5 billion in capital expenditures. Its capital expenditure breakdown was $600 million in information technology, $1.2 billion in supply chain improvements, $500 million in new stores, and $3.2 billion in existing store investments. That means $1,000 of the depreciation expense came from existing assets that ABC Company owned before 2022, while $3,000 came from the CapEx purchases made in 2022. Instead of being able to deduct the full $10,000 for equipment and $5,000 for computer upgrades in 2022, ABC Company was limited to only the first year depreciation expense of $2,000 and $1,000.

Formula and Calculation of CapEx

With real-time visibility into the cash position, you can monitor and control expenses better. CapEx, or capital expenditure, is a financial term that refers to the funds allocated by the company for the purchase of long-term assets. These comprise funds allocated for acquiring, renovating, and maintaining assets. It’s through these assets that businesses are able to carry out their day-to-day operational activities and earn revenues over a period of time. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via depreciation expense. CapEx is the investments that a company makes to grow or maintain its business operations.

What is the difference between capital expenditures and operating expenditures?

This might include upgrading old machines, equipment, or technology systems to newer, more effective models. Expansion CapEx involves investments made to expand the business’s capacity or reach. It can include acquiring new property or land, constructing additional facilities or production lines, and expanding into new markets or geographic locations. Capital expenditure, or CapEx refers to allocating funds toward acquiring, upgrading, or sustaining long-term assets that are crucial for a business’s functioning. These assets can encompass physical infrastructure, equipment, technology systems, and even intellectual properties.

Capital Expenditures: Definition, Calculation, Uses

Additionally, a high CAPEX could also result in lower cash flows in the short term, which could be a concern for companies with limited liquidity or access to capital. It’s worth noting that negative CAPEX does not necessarily indicate a positive or negative performance for a company. For example, if the company is disposing of underutilized or outdated assets to free up capital for new investments or reduce costs, negative CAPEX could be a positive sign. However, if the company is selling off core assets needed for its operations, negative CAPEX could be a warning sign of potential long-term issues.

The straight-line method divides the asset’s cost by its useful life to determine the annual depreciation expense. On the other hand, the accelerated method applies a higher depreciation rate in the early years of the asset’s life and a lower rate in the later years. If the expense is incurred to generate revenue in the future, it is capitalized. For example, if a company develops software that it plans to sell, its cost would be capitalized. If the expense is incurred to maintain the asset’s current condition, it is typically expensed.

CapEx is any money that you invest in either acquiring, improving or maintaining your fixed assets. Capital expenditures are defined as the costs of purchasing and upgrading fixed assets such as buildings, machinery, equipment, and vehicles. This is because tax deductions on operational expenses apply to the current year, while deductions on capital expenditures can be spread out over a period of time through depreciation or amortization.

If deprecation is consolidated with amortization, simply copy the D&A amount in the filing and use the search function to find the footnotes that break out the precise depreciation expense amounts. For the vast majority of companies, Capex is one of the most significant outflows of cash that can have a major impact on free cash flow (FCF). This is treated differently than OpEx, such as the cost to fill up the vehicle’s gas tank. The tank of gas has a much shorter useful life to the company so it’s expensed immediately and treated as OpEx.

This article will guide you through the process of calculating Capex and its importance. Examples include purchasing new machinery, building facilities, acquiring vehicles, and upgrading technology. Capital expenditures should be measured and monitored to ensure they achieve the desired results. Some of the ways to do this include hurdle how to find capex rates, return on investment ratios, and payback periods. A bottom-up approach ensures that all relevant departments have a voice in the budgeting process, which increases the chances of a company’s capital resources being used efficiently. The first step in efficient capital expenditure budgeting is to have a clear and concise plan.